Strategic Steps to Take When Seeking Financial Help Via Loans

Navigating the world of economic support via financings can be an overwhelming job for lots of individuals and businesses alike. From assessing specific economic demands to carefully researching available loan alternatives, each choice made along the way plays a crucial duty in securing desirable terms and conditions.

Assessing Financial Needs

In evaluating one's financial demands before looking for support via fundings, it is crucial to carry out a comprehensive evaluation of income, costs, and lasting monetary goals. Recognizing the present economic standing is an essential action in figuring out the amount of economic support called for. Start by determining the total regular monthly revenue from all resources, consisting of incomes, financial investments, and any various other inflows. Next, checklist out all monthly costs, consisting of lease or mortgage repayments, energies, groceries, transportation, and various other necessary costs. Recognizing optional costs for non-essential products such as eating in restaurants or home entertainment can help in producing a more precise economic picture. When the earnings and expenditures are plainly outlined, it is vital to take into consideration long-term monetary objectives, such as conserving for retirement, buying a home, or financing education. By lining up monetary requirements with objectives, individuals can make educated choices regarding the kind and quantity of financial support needed through finances to achieve their objectives successfully.

Looking Into Funding Options

Discovering various financing choices is a crucial action in securing economic assistance that lines up with individual requirements and circumstances. When looking into lending alternatives, individuals need to consider aspects such as the rates of interest offered by different lending institutions, the repayment terms readily available, and any certain qualification requirements (Online payday loans). It is vital to compare the offerings of several banks to identify one of the most competitive terms and prices

Additionally, researching lending alternatives offers a chance to assess the online reputation and integrity of prospective loan providers. Checking out evaluations, checking the lender's qualifications, and looking for referrals can use understandings right into the high quality of service provided, ensuring a smooth borrowing experience. By performing thorough research, individuals can make educated choices when picking a financing that fulfills their economic requirements.

Comparing Lending Terms

When assessing funding choices, it is vital to compare the terms provided by different loan providers to make an educated choice lined up with one's monetary unsecured personal loan goals and capabilities. Comparing lending terms entails assessing numerous aspects, such as rate of interest, repayment routines, fees, and lending attributes. Passion prices dramatically affect the general expense of loaning, so recognizing whether the rate is repaired or variable and how it will certainly impact regular monthly settlements is necessary. In addition, examining the repayment schedule is crucial to ensure that it straightens with one's income and budgeting choices.

Comprehending the certain functions of each car loan, such as the option for lending consolidation or refinancing, can give extra versatility and benefits. By thoroughly contrasting these loan terms, individuals can select the most ideal alternative that satisfies their financial needs while minimizing unnecessary prices.

Readying Application Materials

Prior to submitting a finance application, setting up the requisite application products is crucial for a structured and efficient procedure. Online payday loans. These products normally consist of personal recognition records such as a motorist's license or ticket, evidence of income such as pay stubs or income tax return, and details concerning any present financial obligations or financial commitments. Additionally, it is necessary to gather details regarding the objective of the finance, whether it be for a home purchase, service investment, or personal expenditures

Lenders commonly sites call for details documents to analyze an applicant's monetary scenario and determine their credit reliability. Taking the time to assemble precise and total application products is a critical action in safeguarding financial assistance via car loans.

Looking For Expert Guidance

As candidates navigate the process of constructing necessary paperwork for their loan applications, seeking specialist advice from monetary experts or lending officers can provide important insights and guidance on fifth third bank auto loan optimizing their monetary profile for boosted authorization opportunities and positive terms. Financial consultants can provide personalized recommendations tailored to specific economic scenarios, assisting applicants comprehend the car loan choices offered and the particular requirements of each. Lending officers, on the various other hand, can give understandings into the criteria used by lending institutions to review financing applications, supplying ideas on how to improve credit score scores or debt-to-income ratios.

Verdict

Devin Ratray Then & Now!

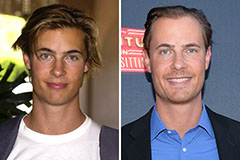

Devin Ratray Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!